All Categories

Featured

Table of Contents

- – Preferred Top Investment Platforms For Accredi...

- – Trusted Accredited Investor Investment Funds

- – High-Performance Investment Platforms For Acc...

- – High Yield Investment Opportunities For Accre...

- – All-In-One Private Placements For Accredited...

- – Award-Winning Accredited Investor Wealth-bui...

- – High-Value Accredited Investor Financial Gro...

The laws for accredited investors differ amongst territories. In the U.S, the interpretation of a recognized investor is placed forth by the SEC in Regulation 501 of Guideline D. To be an accredited financier, an individual has to have a yearly revenue exceeding $200,000 ($300,000 for joint earnings) for the last two years with the assumption of earning the very same or a higher income in the existing year.

A recognized financier ought to have a net well worth going beyond $1 million, either independently or jointly with a spouse. This amount can not consist of a key house. The SEC likewise thinks about applicants to be accredited investors if they are basic partners, executive officers, or directors of a firm that is releasing unregistered protections.

Preferred Top Investment Platforms For Accredited Investors

If an entity consists of equity owners who are accredited investors, the entity itself is an accredited capitalist. Nonetheless, an organization can not be developed with the single purpose of buying particular safeties - top investment platforms for accredited investors. A person can certify as a certified investor by demonstrating enough education and learning or job experience in the financial market

People that intend to be recognized financiers do not relate to the SEC for the classification. Rather, it is the responsibility of the firm using an exclusive positioning to make certain that every one of those approached are accredited financiers. Individuals or parties who wish to be certified capitalists can come close to the issuer of the non listed safety and securities.

For instance, expect there is an individual whose revenue was $150,000 for the last 3 years. They reported a primary home worth of $1 million (with a mortgage of $200,000), an automobile worth $100,000 (with an exceptional car loan of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

Total assets is calculated as properties minus responsibilities. He or she's total assets is specifically $1 million. This includes a computation of their properties (apart from their main house) of $1,050,000 ($100,000 + $500,000 + $450,000) less a vehicle loan equating to $50,000. Because they meet the total assets demand, they certify to be an accredited investor.

Trusted Accredited Investor Investment Funds

There are a few much less typical certifications, such as handling a depend on with greater than $5 million in properties. Under government safety and securities regulations, only those who are approved investors may take part in certain securities offerings. These might consist of shares in private positionings, structured products, and exclusive equity or hedge funds, amongst others.

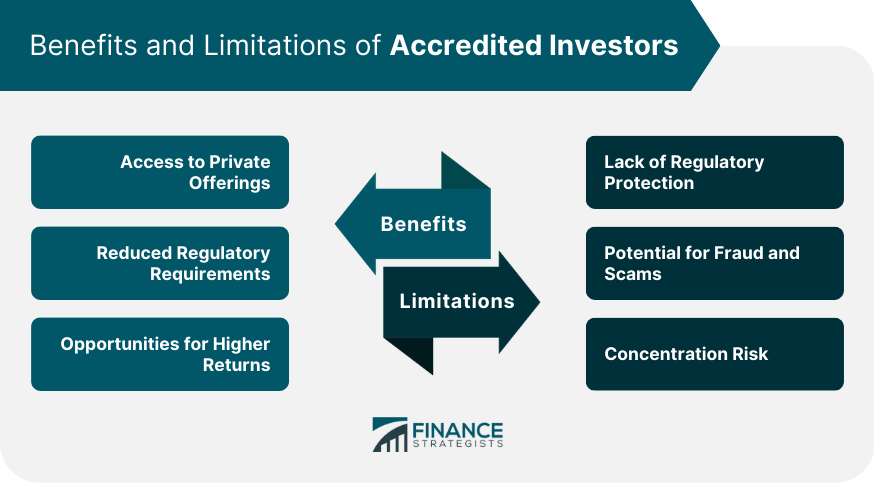

The regulatory authorities wish to be particular that participants in these extremely high-risk and complex investments can take care of themselves and evaluate the dangers in the lack of government security. The certified financier guidelines are made to shield possible financiers with restricted financial understanding from adventures and losses they may be ill furnished to hold up against.

Approved financiers fulfill certifications and expert requirements to gain access to exclusive investment opportunities. Recognized capitalists need to satisfy earnings and internet worth needs, unlike non-accredited individuals, and can invest without restrictions.

High-Performance Investment Platforms For Accredited Investors with Maximum Gains

:max_bytes(150000):strip_icc()/accreditedinvestor_final-f821797e377f4f5aaf1310f1f47d181d.jpg)

Some crucial changes made in 2020 by the SEC include:. Including the Series 7 Series 65, and Collection 82 licenses or various other credentials that reveal financial competence. This change acknowledges that these entity kinds are often utilized for making investments. This change acknowledges the experience that these staff members develop.

This change make up the effects of rising cost of living in time. These amendments increase the accredited financier pool by about 64 million Americans. This larger accessibility offers extra possibilities for financiers, however likewise boosts potential threats as much less economically innovative, capitalists can participate. Businesses using private offerings may benefit from a larger pool of possible financiers.

One significant advantage is the opportunity to purchase positionings and hedge funds. These financial investment alternatives are special to certified financiers and establishments that qualify as an accredited, per SEC laws. Personal placements make it possible for companies to safeguard funds without browsing the IPO procedure and governing documents required for offerings. This gives accredited capitalists the possibility to buy emerging firms at a stage before they think about going public.

High Yield Investment Opportunities For Accredited Investors

They are considered as investments and come only, to qualified customers. In addition to well-known companies, certified financiers can pick to spend in startups and up-and-coming ventures. This provides them income tax return and the opportunity to go into at an earlier phase and potentially enjoy incentives if the company flourishes.

However, for investors open to the dangers entailed, backing startups can lead to gains. A lot of today's technology firms such as Facebook, Uber and Airbnb came from as early-stage start-ups supported by certified angel capitalists. Sophisticated investors have the possibility to explore investment choices that might yield much more earnings than what public markets supply

All-In-One Private Placements For Accredited Investors

Although returns are not ensured, diversity and profile enhancement alternatives are increased for financiers. By diversifying their portfolios with these broadened financial investment opportunities certified financiers can improve their methods and possibly accomplish remarkable long-term returns with correct danger management. Skilled investors usually encounter financial investment alternatives that might not be conveniently readily available to the basic investor.

Investment alternatives and safeties supplied to recognized financiers typically include higher risks. For example, private equity, equity capital and bush funds often concentrate on buying properties that bring danger yet can be liquidated easily for the opportunity of better returns on those dangerous financial investments. Investigating prior to investing is critical these in circumstances.

Lock up durations protect against investors from taking out funds for even more months and years on end. Investors might have a hard time to accurately value personal properties.

Award-Winning Accredited Investor Wealth-building Opportunities

This adjustment might prolong recognized financier standing to a variety of individuals. Permitting partners in dedicated relationships to integrate their resources for common qualification as certified capitalists.

Making it possible for people with particular expert certifications, such as Collection 7 or CFA, to certify as accredited financiers. Creating additional demands such as proof of monetary literacy or effectively finishing an accredited capitalist examination.

On the various other hand, it could likewise result in knowledgeable financiers presuming too much threats that may not be suitable for them. Existing certified financiers might deal with raised competitors for the best investment opportunities if the pool grows.

High-Value Accredited Investor Financial Growth Opportunities

Those who are currently considered certified investors have to remain upgraded on any alterations to the requirements and policies. Companies seeking recognized financiers should stay alert concerning these updates to guarantee they are drawing in the appropriate target market of investors.

Table of Contents

- – Preferred Top Investment Platforms For Accredi...

- – Trusted Accredited Investor Investment Funds

- – High-Performance Investment Platforms For Acc...

- – High Yield Investment Opportunities For Accre...

- – All-In-One Private Placements For Accredited...

- – Award-Winning Accredited Investor Wealth-bui...

- – High-Value Accredited Investor Financial Gro...

Latest Posts

Tax Sale Foreclosure Homes

Tax Liens Investing

Buying Delinquent Tax Homes

More

Latest Posts

Tax Sale Foreclosure Homes

Tax Liens Investing

Buying Delinquent Tax Homes